Infrastructure is considered to be a key driver for the urban economy. Particularly, property-related infrastructure and services are critical for boosting overall development of any urban area. By Provision of the Infrastructure and services cities facilitate efficiency in key economic services, improve the economy’s competitiveness, generate high productivity and wealth and also enhance the quality of life of the people in the cities. Urban externalities generated by cities lead them to substantially contribute to the nation’s Gross Domestic Product (GDP), which has constantly been rising.

Kolhapur Municipal Corporation, in its efforts towards implementation of development projects has introduced reforms in property tax system, which is exclusive in the state of Maharashtra. Span of refinement of the process caused certain period to exhibit stable results. Yet the reforms are successful when measured in terms of sustained revenue rise and acceptability by the citizens. The reforms have been overviewed and presented for the benefit of rest of the municipal corporations not only from Maharashtra but also from other states

Primary Revenue Source

Efficiency in provision of the core property-related infrastructure and services such as water supply, sewerage, stormwater drainage, solid waste, roads and firefighting depend upon own revenue sources of municipal bodies. Property tax is the only own revenue source municipal bodies have to rely upon for the provision of such infrastructure and services. As urban areas expand, properties in their jurisdiction also increase. As the economic activities in the city mature from primary sector to secondary and to the tertiary sector, there is a rise in related demand for more sophisticated, advanced technology-based and efficient infrastructure and services and in turn revenue from property tax. However, in practice, there is a gross mismatch between these two.

Reforms

Followed by Supreme Court Judgments, and to address the issue of resource constraint, many cities have introduced reforms in the procedure for the assessment of properties for property tax. Some of the cities also have simultaneously introduced administrative reforms. Reforms in the property tax system were also a part of the mandatory reforms under Jawaharlal Nehru National Urban Renewal Mission (JnNURM). This was attempted by changes in the base and valuation procedure with the aim of boosting revenue generation potential which is being considered to be the best practices today. Many of the cities through reforms have switched over to alternative value basis so as to use the underutilized potential of the property tax and escape the legal complexities of the Annual Rental Value (ARV) base.

Status in Maharashtra

In the state of Maharashtra, Municipal Acts have provided Capital value as an alternate base. Section129 (1) of Maharashtra Municipal Corporations Act 1949 (Act No. LIX of 1949) provides for levy of property tax on the basis Capital Value, with Rule 7A.1 prescribing how to determine Capital Value. Inconsistent with these provisions, barring Mumbai, a corporation of A+ type megalopolis, only Kolhapur Municipal Corporationhasswitched over to the Capital value base. All the rest of the municipal corporations continue to use Annual Rental Value (ARV) base for the assessment of the properties.

Kolhapur: Trade & Tourism Hub

Kolhapur, a pilgrim place and trade hub known for the Kolhapuri chappal, handicrafts include hand block printing of textiles; silver, bead and paste jewellery crafting; pottery; wood carving and lacquerware; brass sheet work and oxidized silver artwork; and lace and embroidery making. The city is an industrial city with approximately 300 foundries with exports of 15 billion rupees per year.

Administration of Property Taxes in KMC

Shift to the Capital value base by KMC was a unique decision and bold step towards the revamp of the property tax system. Now almost ten years have passed that the system is changed and set also. It would be interesting to know the impact of this change. Kolhapur Municipal Corporation passed a Resolution No.72, dated 18.3.2011, to switch over to the alternative basis of Capital Value for the levy of Property tax.

The System of Assessment prior to the introduction of Reforms

Prior to the introduction of CVS, the assessment was on the basis of ARV. For the owner-occupied properties, ARV was calculated on the basis of carpet area and in case of rental properties as specified in the Maharashtra Municipal Corporations Act 1949, 15 per cent would be deducted from the actual annual rent to arrive at ARV of the property. The reasons for this change as given in the resolution were: firstly, Capital Value System was adopted in accordance with the orders issued by Government of Maharashtra for adopting the Capital Value as an alternative basis for the levy of Property tax. Secondly, for receiving funds under Urban Infrastructure Development Scheme for Small and Medium Towns (UIDSSMT) adoption of Self-Assessment System (SAS) in Property Tax Reforms was mandatory and accordingly KMC had signed MoU with Government of India.

Adoption of this system would have facilitated the SAS. Thirdly, the Project Sanctioning and Monitoring Committee for the approval of the projects related to infrastructure had principally approved to provide substantial funds to Kolhapur Municipal Corporation for the project of 392Cr direct water supply through pipeline from Kallamwadi Dam. 50 per cent grant and 50 per cent loan was to be given to KMC. This was also the reason behind introduction of Capital Value system. Fourthly, it was Government policy to give 25 per cent additional funds under 13th Finance Commission to the corporations adopting Capital Value system as a basis for the assessment of PT. Fifthly, Under Maharashtra Nagarot than scheme to develop link road in the city grant of108 Cr. and `26 Cr to construct a sewerage treatment plant on Dudhali open-drain were sanctioned. In view of all the above commitments, there was no other way than to introduce CVS. Although the shift to CVS was under compulsion it turned out to be beneficial for the KMC. Determination of the Annual Rental Value was the discretion of the Assessor and Collector. There was no transparency in the assessment process. Hence there was a need for the standardization of the process. Moreover under the ARV System, the ARV of the properties being subject to ‘standard rent’ under rent control act, tax rates became exorbitantly high. In certain cases, the tax rate went as high as 103 per cent.

Assessment Procedure

In accordance with the Rule 7 C of Appendix Chapter VIII – Taxation Rules of the ‘Bombay Provincial Municipal Corporations Act, 1949’ KMC made Regulations for the purpose of determining the capital value of the buildings and lands in the jurisdiction of KMC for property taxation. According to RR Capital, Value of Land is

Base Value of the Land in accordance with RR X multiple weightage according to user category X Permissible Floor Space Index FSI X Area of Land

Formula for arriving at capital value is as below:

CV= BV x OF x UC x FSI x AL

BV = Base value

OF = Occupancy Factor

UC = Weightage According to User Category

FSI = Permissible Floor Space Index FSI

AL = Area of Land

According to RR Capital, Value of Building is

Related Base Value of the Building in accordance with RR x multiple weightages according to user category x Weightages according to nature and types of Building x Weightages according to the age of the building x Weightages according to the floor in an RCC building with Lift x Built-up Area

CV = BV x UC x NBT x AF x FF BL

BV = Base value

UC = Weightage According to User Category

NBT = Nature of Building Type

AF = Age Factor

FF = Floor Factor

BA= Built-up Area

Tables of weights have been developed for each of the factors in the formulae and are being referred. Introduction of the location factor in the formula and Ready Reckoner enabled tap the location-specific changes in the value of the properties.

To develop the online system, the existing system has been updated by uploading the database like property number, type, location, and ready reckoner rates. The system generates Short Message Service (SMS) or email to provide the acknowledgement receipt or reference details of payment received. Automatic calculation of the tax amount has eliminated the need for the self-assessment scope for false declaration for reduced tax burden. Publicity for the new system was given through local newspaper, local cable network and advertisement boards and hoardings.

Prior to the introduction of CV, the PT rates were the same for residential, commercial properties, properties located in prime location in interiors or even for slums. To introduce the equity-horizontal as well as vertical-Ready Reckoner RR was developed at the time of introduction of CV. It is commendable that the planning and implementation of new CVS was done entirely internally. Assessor and collector of taxes, system manager and software engineer who was working for city facilitation centre developed the new system of CV. The new system was developed taking into consideration future expansion of KMC. It had taken into account the provisions of MMC Act 1949, Maharashtra Regional and Town Planning (MRTP) Act 1966, Limitation Act etc. The process of assessment got decentralized in the new system.

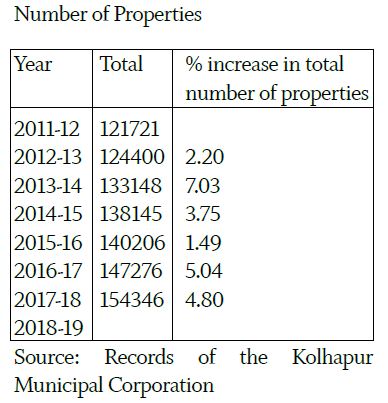

Identification and Growth of properties in KMC

Revenue mobilized through PT is determined by the total number of properties identified, demand raised and its collection. Initially, at the time of introduction of the CV System, the property survey was carried out with the staff of the Public Works Department (PWD), who were also having a good academic background. Subsequently, the new properties were incorporated on intimations from owners and from building permission department. It is understood that the work of the survey has been undertaken in the year 2018-2019. Such surveys should become regular periodic features.

Total number of properties have shown a consistent yearly increase in KMC although the growth rate has been volatile. GIS survey of properties is underway. Number of properties will show substantial increase once it is over.

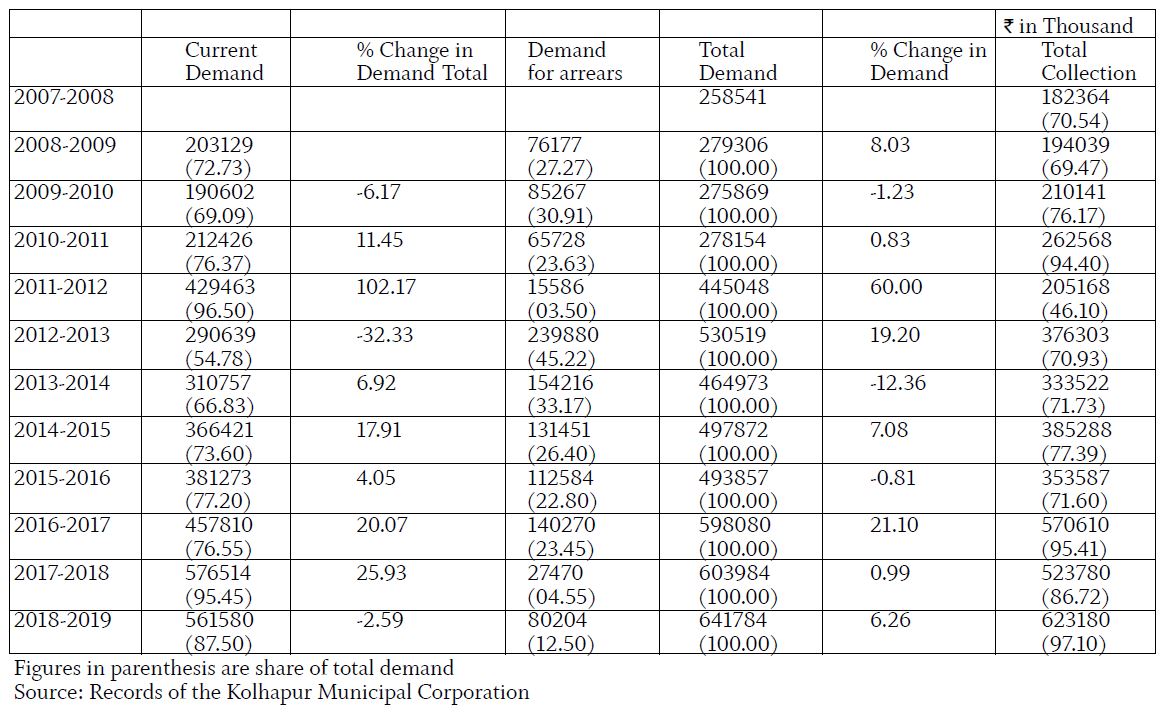

Demand and Collection of the Property Tax in KMC

Total demand is divided into current demand and demand for arrears. A comparative statement of change in Property Tax Demand under Annual Rental Value system (Before Reforms) and under Area- Based Assessment (After Reforms) is presented in the table above.

Two major changes related to PT viz Computerization of records of Property Tax department and online payment of property taxes were introduced by KMC in the year 2011-12, which gave a boost to the demand of PT during 2011-12. During 2011-12, the current demand increased upto 102 per cent over the previous year. Until 2011-12 use of computers was not widespread in KMC. Computers were not many and the data related to property records would be entered manually, hence the process of data entry and generation and printing of bills was very slow. Consequently, there was not much growth in the demand for PT. In fact, in 2009-10 total demand dropped down by -1.23 per cent and in subsequent year it did not reach even 1 per cent. The collection reached a high level of

94 per cent of total demand in 2010-2011. In the year 2011-12 new software with online facility was introduced facilitating the acceptance of the property records online. Even CVS of assessment was introduced in the same year which generated the momentum. Both the reforms together raised the current demand for the year 2011-12 by 102 per cent. However, the collection mechanism could not cope up with the sudden jump in the demand.

Thus recovery was poor 46 per cent during that period. Because of the poor recovery during the year 2011-12, the demand for arrears increased in the year 2012-13 which was more than 50 per cent. Similarly, in the year 2013 -14, the growth trend is seen to be low which is again the result of considerable negative figure of growth in current demand for the earlier year i.e. 2012-13. Overall the current demand has been consistently increasing after the introduction of Capital

Value System.

Collection was consistently good since 2012-13 except for the year 2015-16. Until 2014-15 collection was from House to House (H to H) and hence was very poor. About 120 collection clerks would do H to H collection and manual receipt was given. However, during 2014-15 online collection started and practice of H to H was suspended and the number of collection clerks also reduced to 20. Citizens were not familiar with the system. This affected the recovery for the year 2015-16. With the awareness drive in the following years, the recovery was very good. Because of good recovery demand for arrears also reduced. In 2012-13, the demand seen increased by 19 per cent.

The overall results of the introduction of the CV system seems better in terms of sustained increased revenue. It could be said to be a pioneering model for the other Municipal Corporations to follow. Government of Maharashtra has already issued directions to follow Kolhapur Model. Perhaps simultaneous application of GIS System, digitization of records would have demonstrated much better results. However, the process is underway and will achieve better results. Full-fledged implementation of Self-Assessment System will also further add to the success. Rest of the Municipal Corporations from Maharashtra as well as from other states should follow the Kolhapur

Municipal Corporation.